There are many reasons why you may want to join the solar revolution. You may be trying to get long-term savings on your electricity bill, or you may be motivated to reduce your carbon footprint and be kinder to the planet. But there are two questions that run through the mind of anyone who considers installing solar panels in their home. How will this affect my property value ? & How much money will I save ? At Exterior Energy Consultants of Kansas City, we know that you care greatly about the investment you have in your home and we want to show you how solar panels can potentially boost your property value and save you money.

There are many reasons why you may want to join the solar revolution. You may be trying to get long-term savings on your electricity bill, or you may be motivated to reduce your carbon footprint and be kinder to the planet. But there are two questions that run through the mind of anyone who considers installing solar panels in their home. How will this affect my property value ? & How much money will I save ? At Exterior Energy Consultants of Kansas City, we know that you care greatly about the investment you have in your home and we want to show you how solar panels can potentially boost your property value and save you money.

Let Exterior Energy Consultants Show You The Value of Solar

Let Exterior Energy Consultants Show You The Value of Solar

“EEC” has been in the energy and exterior remodeling business since 1984 and has become one of Kansas City’s leading solar power companies. We’re experts at installing solar panels for both residential and commercial uses. Our professional installers can install your solar panel system outside your home and we’ll explain every step of the process to you. We’ll also consider the area and size of your roof as well as the direction and pitch of it in order to determine how to maximize the amount of energy your solar panels take in. Unlike other companies, we’ll customize your solar panels to fit your needs and you will get engineered stamped electrical and structural plans of your Solar project regardless rather your local municipality requires it or not before we start. We want you to get the most value out of your solar panel system and we feel that starts with piece on mind from day one.

What You Need to Know About Solar and Property Value

There are also numbers that show installing solar panels increase property values. According to the US Department of Energy, studies show that home buyers are willing to pay a premium of about $15,000 for homes with solar, we are seeing figures closer to 22,000 in the Kansas and Missouri Real Estate market. One of the first questions has to do with how the panels look. Many people think they’re going to be large and bulky, but modern solar panels don’t have look like that. The aesthetics of panels have greatly improved over the last few years, with black, low-profile mounting systems. Solar panels are sleeker, thinner, and more efficient than they were only three years ago.

Next, you should look at short term costs. One thing to keep in mind is that some of the costlier systems to purchase and install will actually pay off for you in the long term. “Many of the more expensive systems have better efficiency and produce more power in the same amount of space’’ These systems not only have better ROI but more often have better warranties as well.

Incentives & Rebates For Going Solar and Why Now vs Later ?

In Missouri , there are incentives including KCP&L Solar Power Rebate program which offers incentives to reduce the installation costs of solar for both residential and commercial customers but the funds are limited and are first come first serve so when they are gone they are gone.

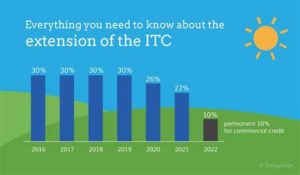

The Residential Energy Property Credit, also known as the Solar Investment Tax Credit “ITC” is an amazing benefit courtesy of the Federal Government for homeowners and businesses.

Please remember to check with your tax professional to discuss your personal tax situation; as this article is only for general informational purposes and may not apply to your own tax situation. We cannot offer tax advise. You may also check with the IRS website for more detailed information. You may want to check out the IRS tax tip

In either case, if you are considering installing solar panels on your home, it may benefit you to do it sooner rather than later as the Solar Tax credit for residential homes will be reduced at the end of 2019 and fully expire by 2021. According to the IRS, 2019 is the last year in which you can claim the full 30% credit, being reduced to 26% in 2020, then down to 22% in 2021 and eliminated completely thereafter.

In either case, if you are considering installing solar panels on your home, it may benefit you to do it sooner rather than later as the Solar Tax credit for residential homes will be reduced at the end of 2019 and fully expire by 2021. According to the IRS, 2019 is the last year in which you can claim the full 30% credit, being reduced to 26% in 2020, then down to 22% in 2021 and eliminated completely thereafter.

The Main Requirements for Getting the Solar Tax Credit are as Follows:

1. You must purchase (cash or finance) a Solar photo-voltaic system. Beware if you lease or do any of the “creative” power purchase agreements (PPA) that many of our solar competitors are pushing, you cannot claim the solar tax credit regardless of what you are told, and it can have a negative impact on the value of your home.

2. You paid or will pay federal income taxes in the year you claim the solar tax credit. Check with your tax preparer or tax professional to verify that you have a tax liability for the year you want to claim the credit.

Remember that Solar Tax credit for 2019 applies to both businesses and homeowners and there is no cap on its value !!!

Exterior Energy Consultants of Kansas City Will Help You Find Out If You Can Benefit From Solar Power

Exterior Energy Consultants of Kansas City Will Help You Find Out If You Can Benefit From Solar Power

Everyone wants to save money on their energy bill and solar can lower your costs and even depending on your utility company have them pay you for excess power you produce. You can make your home more attractive to buyers by installing solar. To find out more, call (816) 468-8400 or Email Exterior Energy Consultants today for your No pressure Free Energy Audit using your homes actual data to see if Solar is truly a good fit for your home or business.